About

Context

The overarching objective of the RoundBaltic project is to support the implementation of the Smart Finance for Smart Buildings (SFSB) initiative in the Baltic Sea Region, notably the project’s direct target countries Poland, Latvia and Denmark.

The three pillars of Smart Finance for Smart Buildings concern:

- Better use of public funds by maximising the use of available public funding via financial instruments, addressing identified market failures and by better targeting grants towards vulnerable consumers. Tailored financing schemes and risk-sharing mechanisms supported from public funds are good for leveraging private investment in sustainable energy.

- Project aggregation and assistance increasing availability of a large-scale pipeline of bankable projects to feed investment platforms and financial instruments. This can be achieved through, among others, project development assistance and promotion of one-stop-shops for project developers.

- De-risking of energy efficiency investment by revealing the real risks and benefits of sustainable energy investments based on market evidence and performance track record, and development of dedicated sustainable energy building financing products.

The RoundBaltic intervention can help to smooth this process and represents a way to find structured solutions for accelerating energy efficiency investments in Poland, Latvia and Denmark. This will happen in interaction with related policy initiatives such as the Green Deal, the Energy Union Governance and associated National Energy and Climate Plans, public funding programmes and EU’s SEI Forums that aim to bridge the energy efficiency and financial sector on broad European scale.

3 national roundtables were held in each of the three target countries: Poland, Latvia and Denmark interacting with 2 regional roundtables in each of 12 regions (7 regions in Poland, 2 in Latvia and 3 in Denmark)

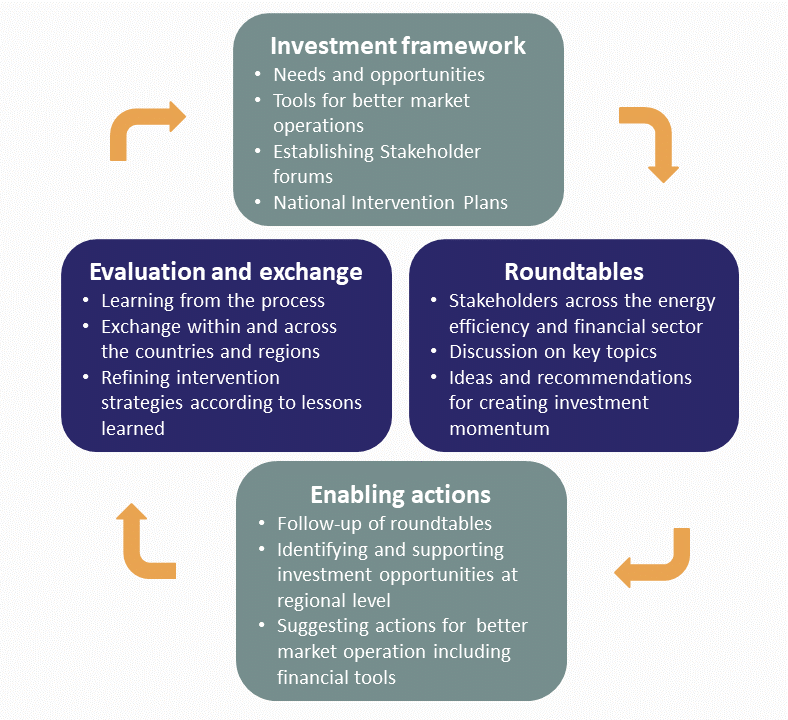

RoundBaltic aimed to facilitate discussions and solutions in the energy efficiency finance sector for Poland, Latvia, and Denmark. The project focused on creating an investment-friendly framework, designing financing instruments, and initiating sustainable energy investments. Stakeholder engagement through roundtables played a crucial role in transforming ideas into actions, supported by a structured framework for energy efficiency investments.

Support activities included policy implementation, financing instrument setup, and capacity-building for both financial and energy efficiency sectors. Diagnosing needs and opportunities in each country guided the overall support framework, complemented by Advisory Boards overseeing project implementation.

Roundtables served as forums for stakeholders to exchange ideas, learn from successful initiatives, and provide input into policy-making. The project followed a standardized approach for national and regional roundtables, resulting in a significant number of interactions and recommendations.

Enabling actions aimed to transform roundtable recommendations into specific energy efficiency finance actions. Initiatives such as inter-municipal cooperation, one-stop-shops, and project aggregation simplified project journeys and attracted private capital for financing.

The project’s impact assessment revealed a substantial increase in sustainable energy investments, surpassing the initial investment target. RoundBaltic collaborated closely with national financing organizations and institutions to bridge the gap between the financial and energy efficiency sectors.

Dissemination and communication activities were conducted to inform stakeholders about the project and its potential impact on energy efficiency finance in the Baltic Region. Efforts were made to establish a permanent structure involving relevant stakeholders to ensure continued support for energy efficiency measures in the long term.

In conclusion, RoundBaltic’s participatory intervention had a significant impact on boosting energy efficiency finance in Poland, Latvia, and Denmark, addressing various aspects of the investment framework and initiating specific investments.

View case studies, articles, reports, press release and news letters from the project